Tick all the boxes for

Compliance

Leave the on-boarding and KYC process to us and use your time to grow your business.

Security for you

We provide a built-in KYC process to verify all merchants and prevent merchant fraud.

Secure for merchants

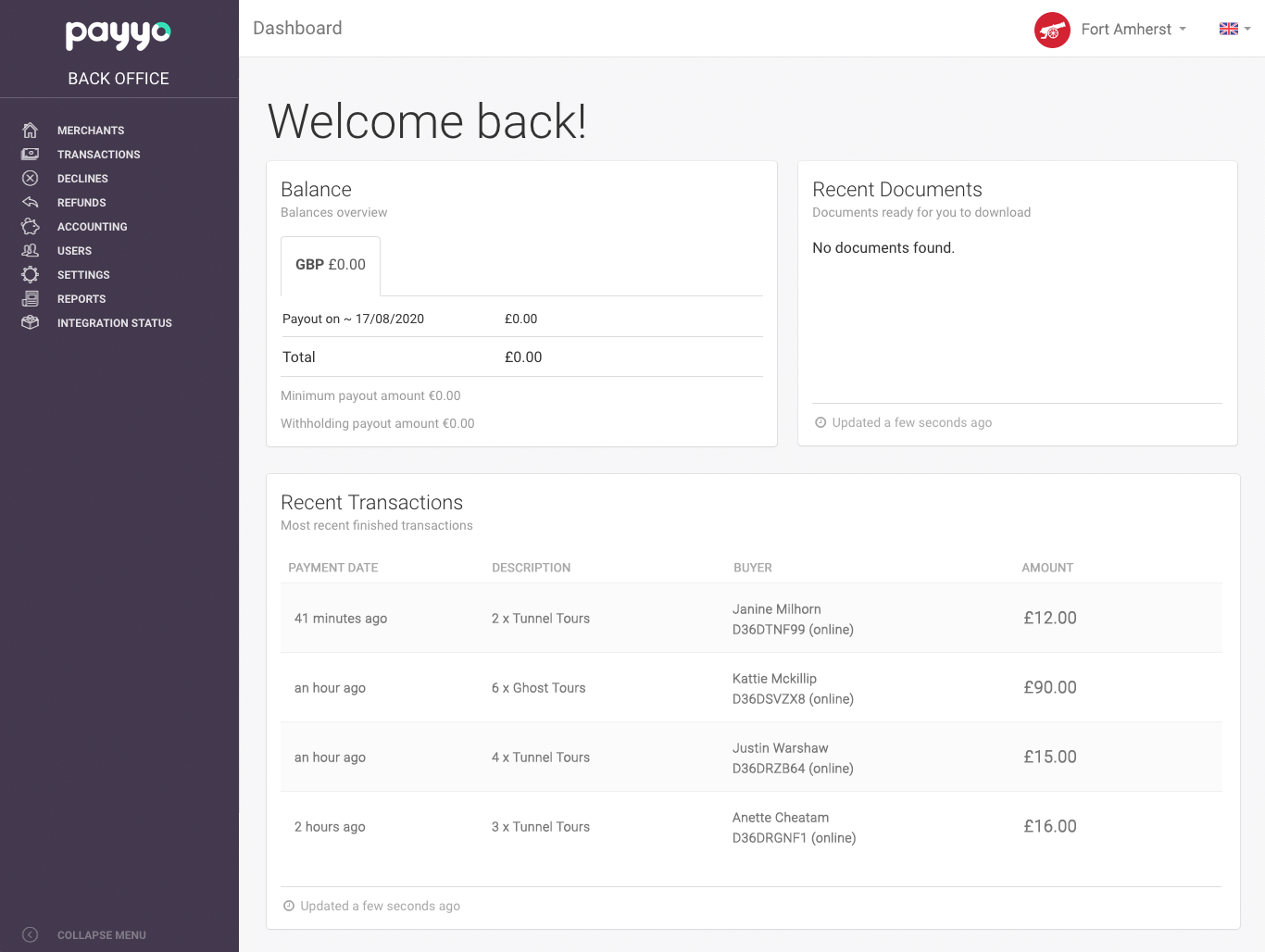

To minimize fraud, Payyo flags, monitors and disputes transactions on your behalf.

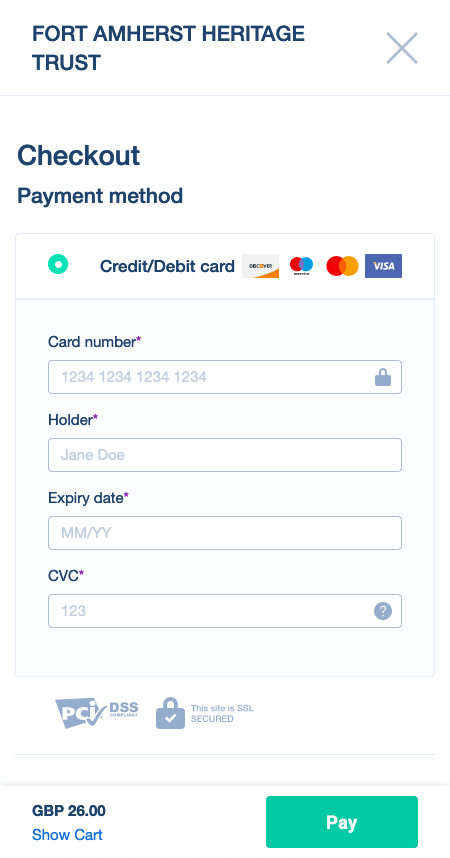

Secure for end customers

Payyo is enabled by SIX, Stripe and Wirecard, all PCI II compliant payment services.

KYC

Know Your Customer

The Know Your Customer (KYC) process is a legal requirement to comply with financial services. This also helps to prevent fraudulent merchants from abusing platform, creating a safer environment.

To adhere to KYC obligations, we collect and maintain information of all merchants that process payments via Payyo. We do this through a user-friendly, built-in KYC process that merchants need to complete before receiving payouts.

Ready for KYC

Sole traders and registered companies are welcome

Our KYC process will only ask for the necessary information depending on whether the merchant is a sole trader or a registered company.

We make it simple and easy for your clients to start receiving payouts with Payyo.

Our Commitment

- We’re committed to being the gold standard for platform & marketplace payments in the travel & leisure industry.

- We help our clients to increase their margins and drive success. Payyo is built on partnerships. When you grow, we grow.

“Payyo helps us to empower our customers to accept all kinds of payments, no matter where they are in the world and at competitive credit card rates.”

Dennis Klett

CEO of Lodgify, the all-in-one SaaS solution for vacation rental owners

“Payyo is an integral part of our business. We service clients in over 100 countries and required a gateway to operate globally without numerous 3rd party integrations.

Olan O'Sullivan

CEO of TrekkSoft, the booking software provider for tours and activities